Product Description

Swift Remit is the remittance of RMB cash or RMB funds in the personal settlement account of the remitter through CCB’s network to the personal settlement account of the payee at different locations at the authorization of the remitter.

Three major reasons for selecting Swift Remit

1. Swift, secure, reliable and convenient service across the nation. The swift remit service, the recipient may withdraw the remittance immediately after you remit the money. The swift remit network covers the whole country and any CCB outlet may offer this service.

2. 24-hour services. To facilitate remittance during non-business days, Swift Remit offers service on non-business days as if they were business day. Any networked CCB outlet may provide remittance and withdrawal services. The client may also use his or her card to make withdrawals on CCB ATMs, self-service outlets, and the ATMs of other gold-card network banks across the nation.

3. Reasonable Charges. According to regulations, charges on Swift Remit are subject to an upper limit. The client is charged 1% of the remitted amount, subject to a minimum of RMB 2, and a maximum of RMB 50. Therefore, the more the client remits, the greater economic sense it makes. If the client does not withdraw the remittance when it reaches his or her account, CCB pays interest at the rate for demand deposits.CCB also carries out promotion activities for clients who often use CCB’s swift remit services.

Functions

1. Varied forms. Swift Remit offers the cash-to-card, cash-to-bankbook, bankbook-to-bankbook, bankbook-to-card, card-to-bankbook, card-to-card remittance functions.

2. Wholesale remittance. Swift Remit offers one-to-multiple remittance functions, including third-party collection and payment.

3. Any networked CCB outlet may provide remittance and withdrawal services. The client may also use his or her card to make withdrawals on CCB ATMs, self-service outlets, and the ATMs of other gold-card network banks across the nation.

4. Immediate arrival. The remittance will arrive at the account of the recipient at any local CCB networked outlet immediately after it is remitted.

5. Convenient inquiry. The remitter and the recipient may inquire the remittance information at the counters of networked outlets, by dialing 95533, though ATM and on-line banks and other channels.

Service Channels

CCB’s outlets, self-service banks, telephone banking, and on-line banking.

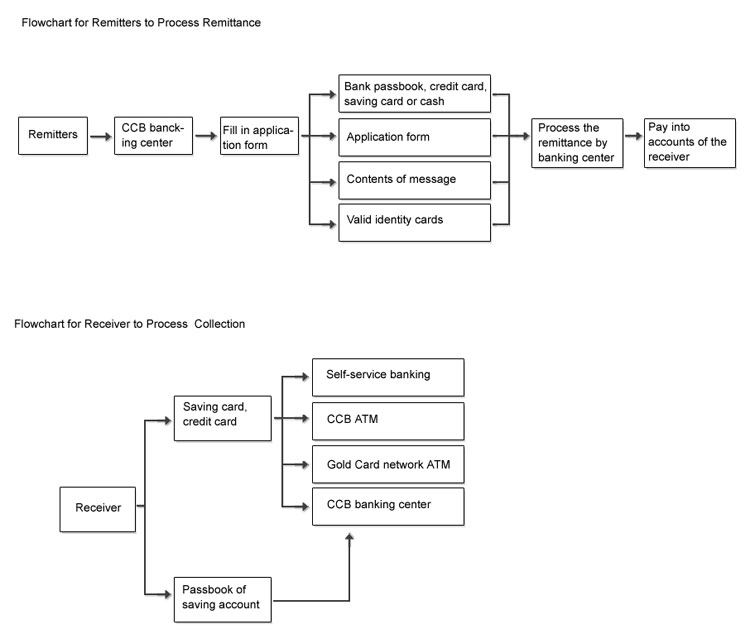

How to Remit

If you wish to remit at CCB counters, the client only needs to fill out the Application Form for Swift Remit, which includes the name and account number of the recipient, the name of the destination, the name and account number of the remitter, the name of the origin, amount, the name and number of valid personal certificate, the identification card, and proof of deposits/cash. When the remittance fees are paid, you may start Swift Remit. You may also do self-service remittance through on-line banking.

User Guide