Personal purchase of foreign exchange, or personal purchase of foreign exchange by Chinese residents for personal business, refers to the purchase of foreign exchange from the bank by individual Chinese residents to meet expenses as approved by regulations.

Three major reasons for subscribing CCB’s personal purchase of foreign exchange

1. Efficient CCB has the most advanced system for personal purchase of foreign exchange, which simplifies the processing procedures and saves time for clients.

2. Convenient. The outlets that are eligible for providing this service are increasing and the client now has more choices.

3. Fast. CCB offers one stop service from approval to transaction and the client needs not to rush between the foreign exchange administration and the bank.

Functions

1. Interconnected examination. The system of CCB is interconnected with the system of foreign exchange administration to examine the qualification of Chinese residents for purchase foreign exchange.

2. Automatic account transfer. CCB offers the transfers of different currencies at different saving accounts.

3. Inquiry. The client may inquire the internal discount rate, the maximum purchase amount, exchange rate, write-off, the required documents and other information.

4. Automatic cancellation. If the transaction cannot be completed that day, the system will automatically cancel all the transaction information when the business day ends.

Service Channels

Outlet counters and wealth management centers.

Target Clients

Chinese residents, or Chinese citizens who have not become permanent residents of other countries. Foreign citizens (or people of no nationality) residing in China may purchase foreign exchange at banks authorized by the State Administration of Foreign Exchange. Foreign citizens and residents of Hong Kong, Macau, and Taiwan staying in the PRC are subject to different regulations.

Types of Personal Purchase of Foreign Exchange

Residents may purchase foreign exchange for the following purposes: personal trips abroad, trips for religious worship, visiting family, seeking medical treatment abroad, education, business trips, training abroad, work, paying membership in international organizations, shopping by mail, settling down overseas, assisting family overseas, international exchange, labor, paying examination and application fees, among others.

Required documentation and Amount Guidelines

1. Purchasing foreign exchange for foreign trips (excluding trips to border areas and for education): including personal trips abroad, trips for religious worship, visiting family, seeking medical treatment abroad, business trips, work, settling down overseas, international exchange, training abroad, and short-term study, labor, etc.

A. Required documentation: The client must present a written application, passport, valid visa, personal identification, and household registration records.

B. Guidelines on amounts: If the visa indicates a departure date within six months, each person may purchase the equivalent of 5000 dollars (or 5000 dollars) for each trip; if the visa indicates a departure date beyond six months (including six months), each person may purchase the equivalent of 8000 dollars (or 8000 dollars).

2. Purchasing foreign exchange for border trips: applicable when the client purchases foreign exchange for use during tourist trips to a neighboring country through a Chinese port of entry.

A. Documentation: “Application for Purchasing Foreign Exchange for Touring a Bordering Country,” the visitor’s private passport or pass for border tours, identification or household registration records.

B. Guideline on amounts: the equivalent of 100 US dollars per day per person (or 100 USD); limited to the equivalent of 500 US dollar per trip.

3. Purchasing foreign exchange for foreign education: applicable to all persons purchasing foreign exchange for studying abroad.

A. Documentation: The client must present a written application, passport, valid visa, identification and household registration records.

B. Guidelines on amounts:

a. If the client provides an official statement of tuition and living expenses, and the amount purchased is below the equivalent of 20,000 US dollars (including 20,000 USD) per year, he or she may purchase the full amount listed in the statement. If the amount exceeds 20,000 USD, it is subject to approval by the State Administration for Foreign Exchange, and the client may purchase the amount approved by the SAFE.

b. If the client cannot provide an official statement of tuition and living expenses, and his or her visa indicates a departure date within six months, he or she may purchase the equivalent of 5,000 US dollars; if the visa indicates a departure date beyond six months (including six months), the client may purchase an equivalent of 8,000 USD per study trip.

4. Foreign exchange not purchased for a foreign trip: applicable when the client does not need to travel abroad, but needs to purchase foreign exchange to pay fees for membership in an international organization, assist family abroad, and shop by mail.

A. Documentation: The client must present a written application, passport, valid visa, identification, and household registration records.

B. Guidelines on amounts: the equivalent of 5,000 US dollars per person per time.

5. Chinese citizens holding the foreign currency cards issued by domestic banks consume under the current account for overdraw the account abroad, the cardholder may go to the issuing bank to purchase foreign exchange for repayment.

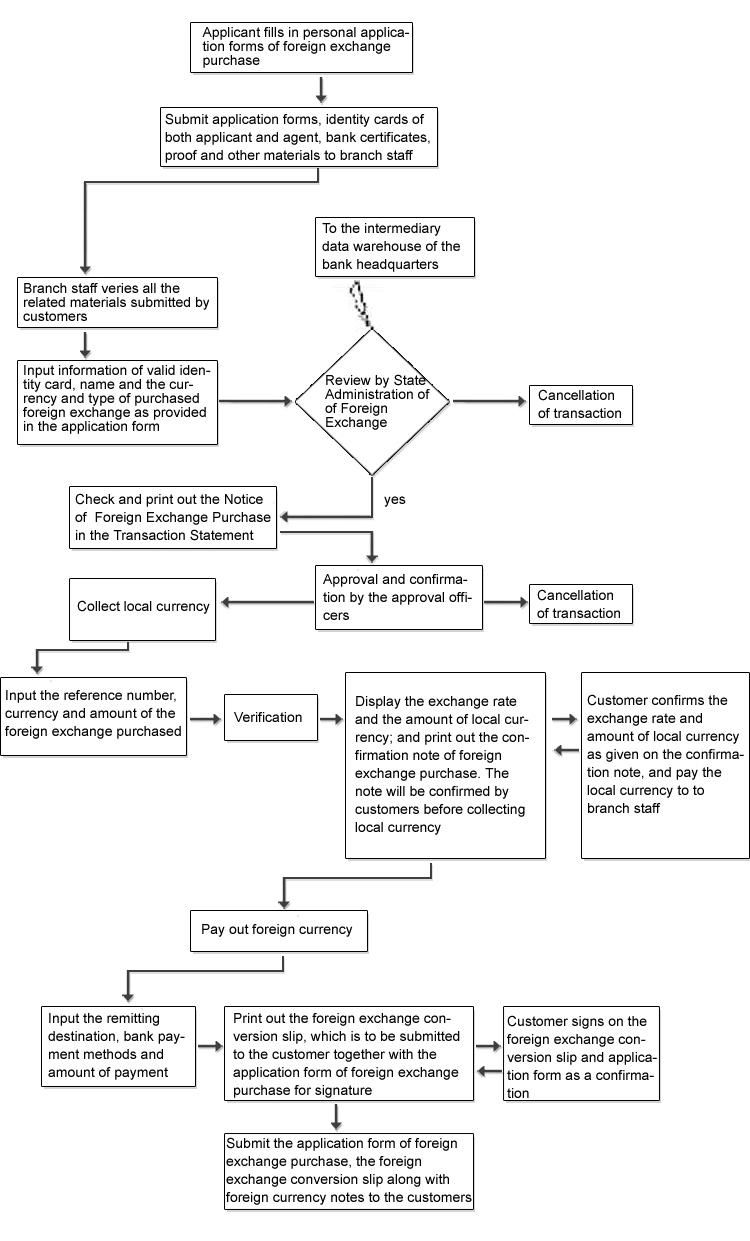

Flowchart

Special Notes

1. If you need to purchase a greater amount of foreign exchange than listed above, you must file the above documents with your local branch of the SAFE. After receiving approval, you may make your purchase at CCB with the SAFE’s statement of approval and other required documentation.

2. To meet your needs, you may choose to carry the foreign currency you have purchased in the forms of money order, traveler’s check, or credit card. You may also choose to hold cash, but the cash you draw may not exceed the equivalent of 5000 US dollars (or 5000 US dollars). However, if the money is used to pay tuition, fees for membership in an international organization, or mail-order charges, it must be remitted by the bank directly to the school, international organization or foreign personal bank account; no cash may be drawn.

3. According to the regulations of the SAFE, after selling foreign currency to you, CCB places a special stamp marking the sale on a “Notes” page of your passport or your pass to Hong Kong or Macau.

4. After purchasing foreign currency, you should keep the receipt and other documents, so that when you need to make a second purchase, you will be able to show them.