The permit to carry foreign currency abroad is printed solely by the State Administration for Foreign Exchange and issued by a bank. It indicates permission to carry foreign currency cash or negotiable commercial papers abroad. It must be presented to a customs officer. The validity of the permit lasts for 30 days from the day of issuance.

Target Clients

According to regulations, CCB issues permits to carry foreign currency abroad to persons who have foreign currency accounts with CCB, provided that they have the approval to carry foreign currency abroad to settle down there, visit family, travel, take study tours, and attend school.

Service Channels

CCB’s outlets

Maximum Amounts

A person traveling abroad do not need a Permit if the amount of foreign cash he or she carries does not exceed the equivalent of 5000 US dollars (including 5000 US dollars); if the amount of foreign currency cash the person carries is between the equivalent of 5,000 USD and 10,000 USD (inclusive), he or she must apply to an authorized bank for a Permit. The person will be allowed to pass the customs by presenting a Permit stamped by an authorized bank. Generally, a person is not allowed to carry abroad more than the equivalent of 10,000 USD. However, if one of the following conditions applies, a person traveling abroad may apply to the SAFE for a Permit.

1. A group comprising of a large number of people traveling abroad;

2. A group on a scientific-study trip that lasts for a long time or that covers a long distance;

3. A government official visiting abroad;

4. A person traveling to countries where there is war, strict foreign exchange controls, lack of financial services, or financial instability;

5. Other special circumstances.

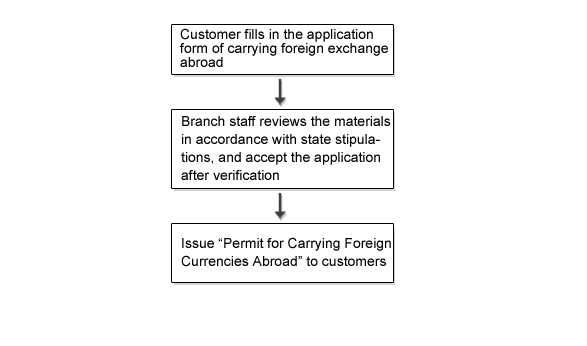

Client Process

1. The client draws cash or purchases foreign currency negotiable commercial papers at CCB, fills out an application to carry the foreign currency abroad, and present a passport, valid visa, pass or a notice to travel abroad.

2. The teller verifies the documents and issues a permit to carry foreign currency abroad to the client according to the regulations of the SAFE.

Special Notes

1. A Permit is valid within 30 days of issue, and can be used only once;

2. If the amount of foreign currency to be carried abroad exceeds the limit imposed by the SAFE, the applicant must present to the bank a statement of approval issued by the SAFE.

Flow Chart